It’s impossible to know the direction any individual stock (or the stock market as a whole) will go at any point in time. Fortunately, successful investing does not require predicting precisely how investments will be priced at specific times. If it did, investing would be purely based on luck rather than research and analysis.

While investing doesn’t require perfection, it does require patient adherence to established best practices—something which can be easier said than done. We all view the world through a unique lens colored by our personal experiences. Often, our views lead us to invest based on feeling more than fact. In this insight, we’ll identify some of the most common behavioral biases—and how to overcome them.

Avoid Overconfident Investing

“I’ve made good choices before. I think my good fortune will continue.”

Overconfidence causes investors to overestimate their abilities, and it is common among investors who have selected individual stocks which have appreciated. Initial choices with positive outcomes can cause them to hold onto winning stocks for too long instead of diversifying their portfolio and reducing risk.

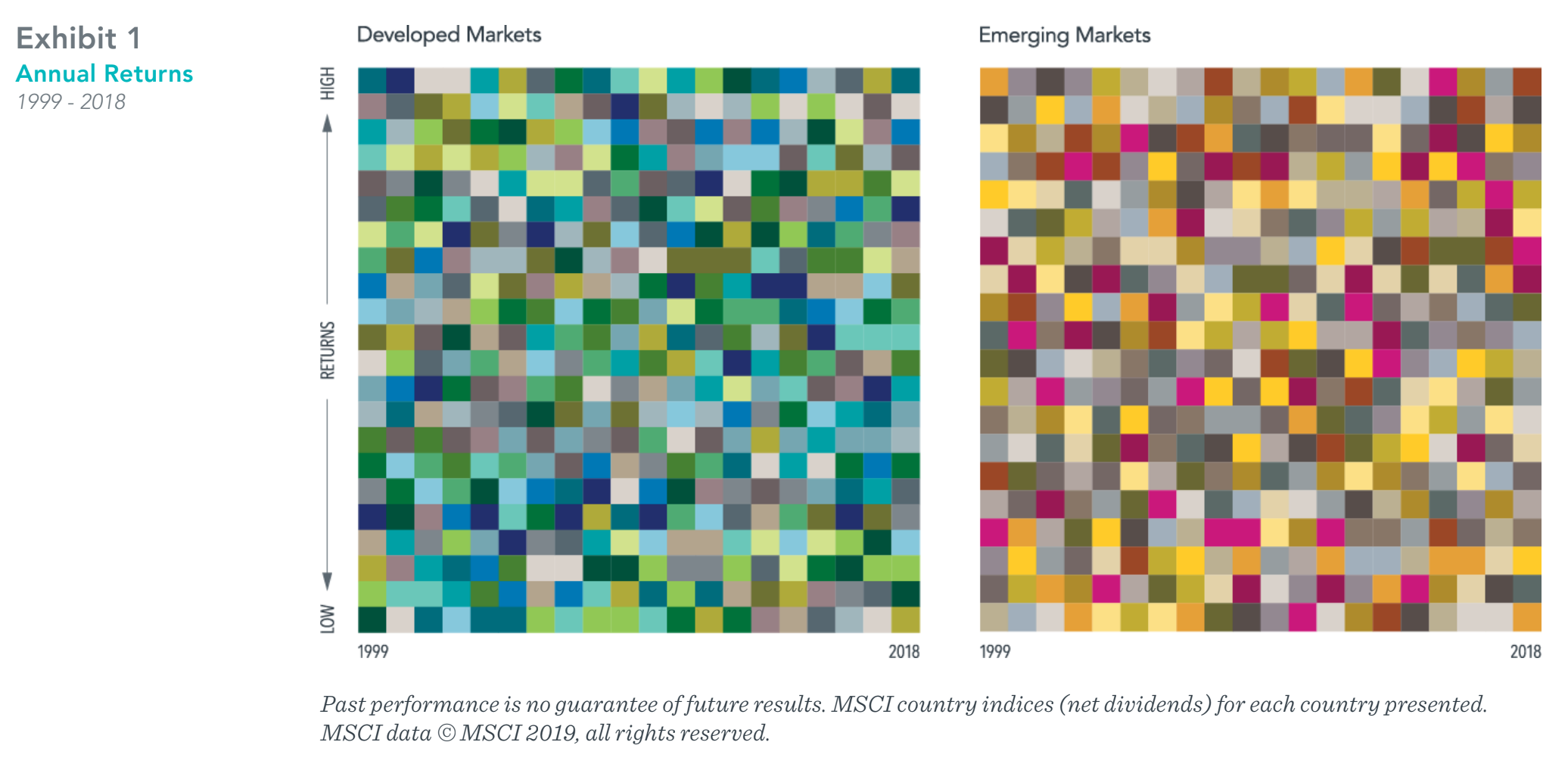

To combat this line of thought, it’s helpful to step back and consider the unpredictability of results across the globe. The chart below shows developed and emerging market returns from 1999-2018. Each color represents a country. Pick a color and follow that color through the years. Are you able to identify a pattern?

We’ve posed a trick question. The takeaway is the lack of identifiable pattern. The amorphous style of the colors demonstrates the randomness of global stock returns.

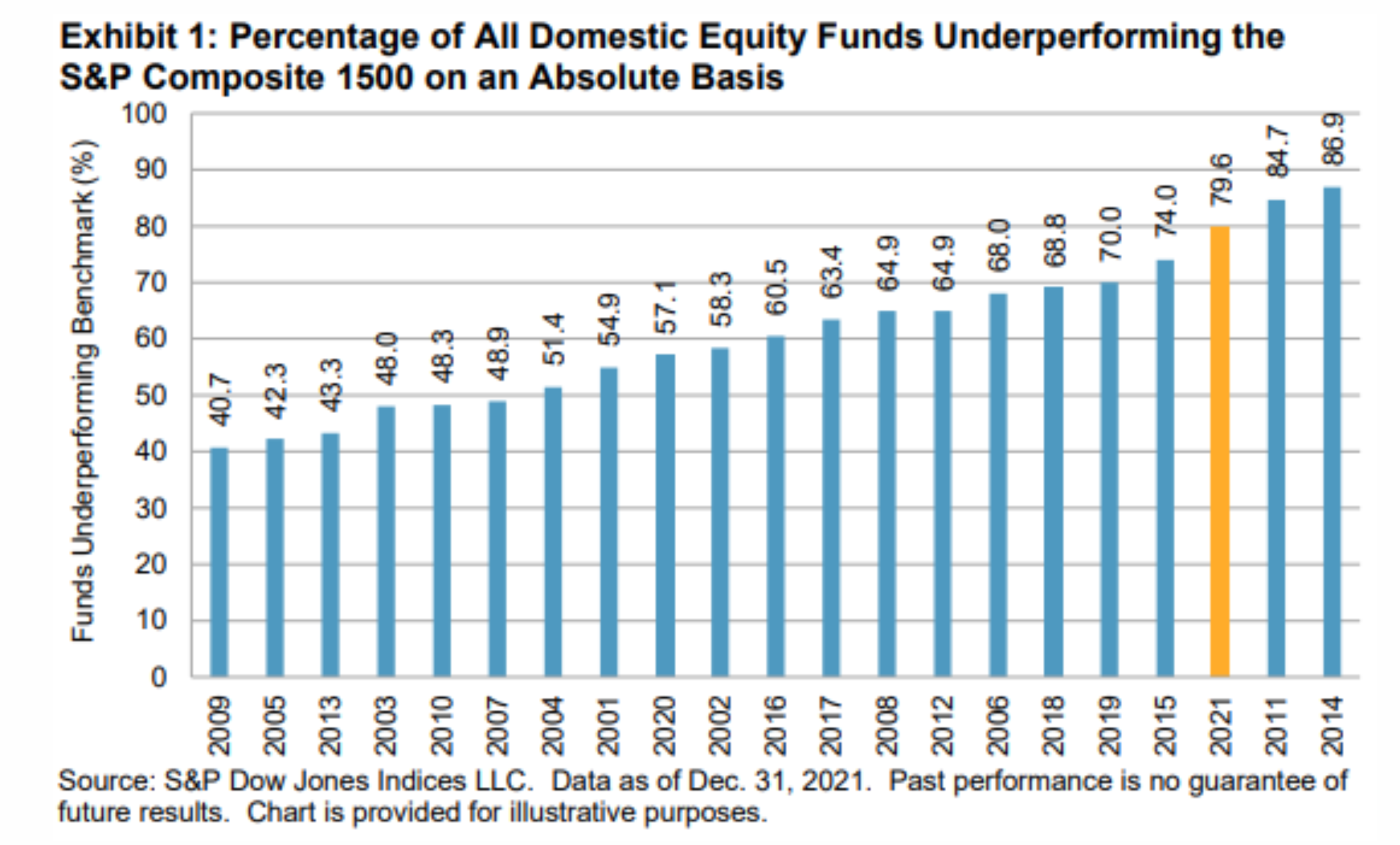

Even if you think you are skilled at selecting stocks, research shows active investors underperform their benchmarks. For the decade from 2012-2021, fewer than 15% of active professionally managed U.S. funds with large capitalization stocks beat the market returns. The market has proven to be powerful in processing information. In timing the market, an investor assumes their knowledge is superior to all market participants.

Beware of Loss Aversion

“I’d rather not invest during a downturn. I’ll wait until the market recovers.”

Many investors experience loss aversion, which means that they are biased toward avoiding losses versus maximizing long-term gains. This bias can lead to hesitation to invest during a downturn due to fear that the market will decline further. This fearful behavior runs contrary to the established academic investing principle that “time in the market is better than timing the market.” Loss aversion can result in lost opportunities to buy at a discount and benefit from more substantial appreciation.

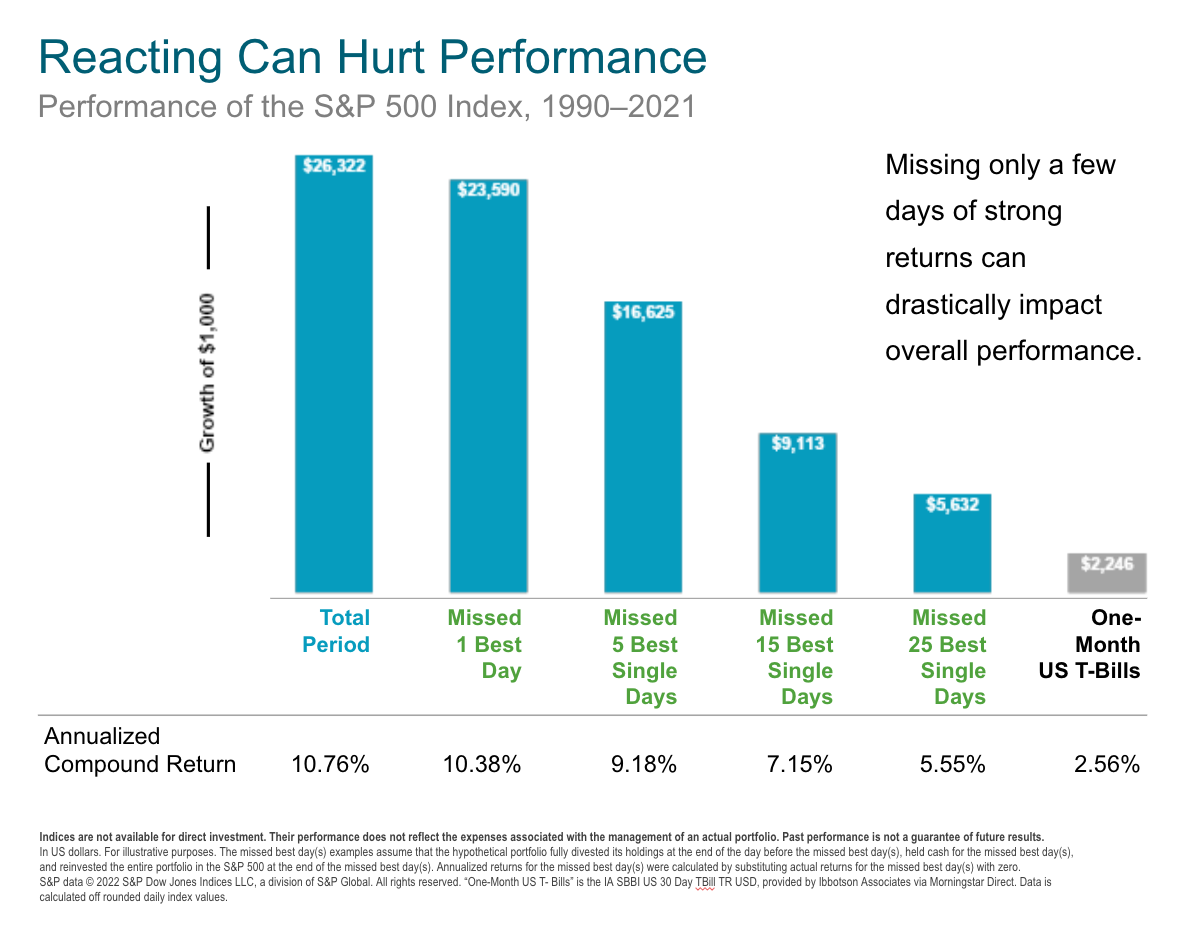

If you wait for certainty, you’ll miss opportunities. For example, an investor in the S&P 500 index from 1990 to 2021, earned an annualized compounded return of 10.76%. If the same investor missed 25 of the best single days during the 31-year period, they would earn a return of merely 5.55%. Further, if they didn’t invest at all and bought Treasury bills at the risk-free rate, they would earn 2.56%.

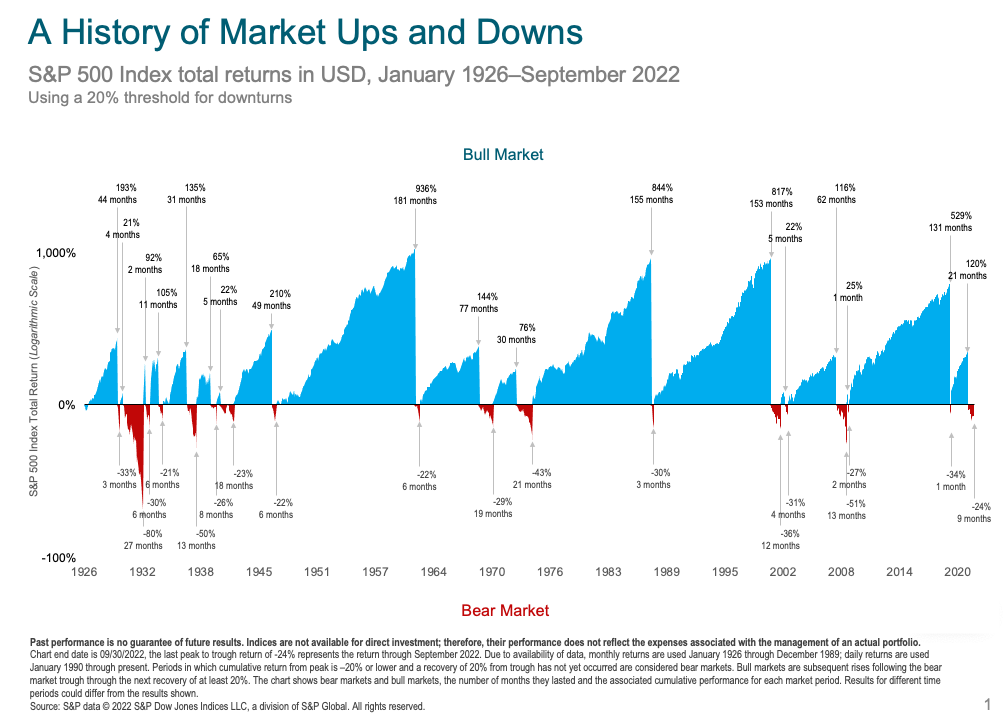

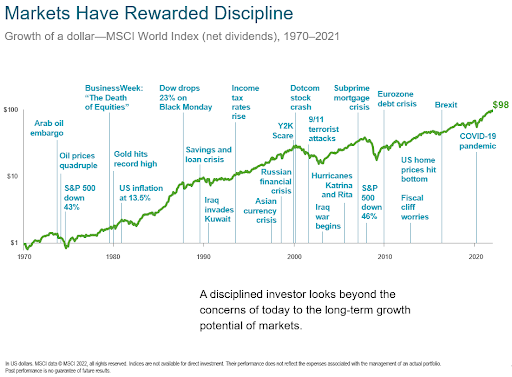

The market rewards investors who invest for the long term. In reviewing the history of markets since 1942, the average bull market lasted 4.4 years. Meanwhile, the average bear market lasted 11.3 months. While past performance is not reflective of future results, and no one knows the direction the market will go in any one year, we have decades of data that shows the market will recover. When you find yourself hesitant to invest, remind yourself “this too shall pass,” and stay focused on your long-term goals.

Don’t Let Media Pessimism Distract from Best Practices

“The media is full of reasons not to participate in the market. Why should I invest?”

The media seeks high viewership, and some would say, “if it bleeds it leads.” There’s been no shortage of reporting on war, disease, energy shortages, and inflation recently in the news. Herd behavior bias can cause investors to follow others’ pessimistic reading of this news instead of making their own decisions.

This bias can be overcome by taking a step back and focusing on the long term. Keep in mind Warren Buffet’s reminder that it’s best to, “be fearful when others are greedy and greedy when others are fearful.”

Conclusion: Disciplined Investing Means Accepting We Can’t Control Everything

“If I can’t control so many of these factors, what’s the point?”

As individuals, there are so many factors outside our control (i.e., who is in office, tax rates, how the economy performs, etc.) that it can be easy to blame external factors for financial hardships. In this context, life will seem much more manageable if investors step back and focus on the factors they can control. As investors, we can control how much cash we have on hand for a rainy day, how much we are putting into investments monthly, and how much we choose to spend on goods and services. If we have well-defined goals and a plan rooted in a long-term perspective, we can position ourselves for success while acknowledging that perfection isn’t possible in a chaotic, ever-changing global economy.

The best time to invest was yesterday, which means the second-best time to invest is today. Once we acknowledge the normal ebbs and flows of financial markets, we can accept that we don’t need to be perfect to be successful. At Wealthstream Advisors, we help equip our clients with the knowledge and support they need to make clear-eyed financial decisions (even when human nature makes it tempting to panic).