A Charitable Remainder Trust (CRT) is an irrevocable trust that provides income to beneficiaries until a specified time, after which the remainder of the assets in the trust are donated to a charity. Utilizing a Charitable Remainder Trust is a gifting strategy that has tax benefits and can accomplish both charitable and estate planning goals.

Benefits of Charitable Remainder Trusts

Tax Savings: In the year that the trust is funded, the donor receives an income tax deduction. An individual can donate highly appreciated assets to the trust. Because it is a charitable entity, the trustee can sell the asset and avoid paying capital gains tax.

Income Stream: The donor can name himself or herself as a beneficiary to receive an income stream for life. The ability to diversify from a concentrated position helps to reduce investment risk and, the income stream is off of a higher principal amount than it would have been had there been a capital gains tax.

Estate Savings: When the trust is established, the assets placed into the trust are considered outside the individual’s estate thus lowering potential estate taxes.

Charitable Intentions: At the passing of the income beneficiary, the remaining trust assets are donated to the selected charities.

Case Study 1

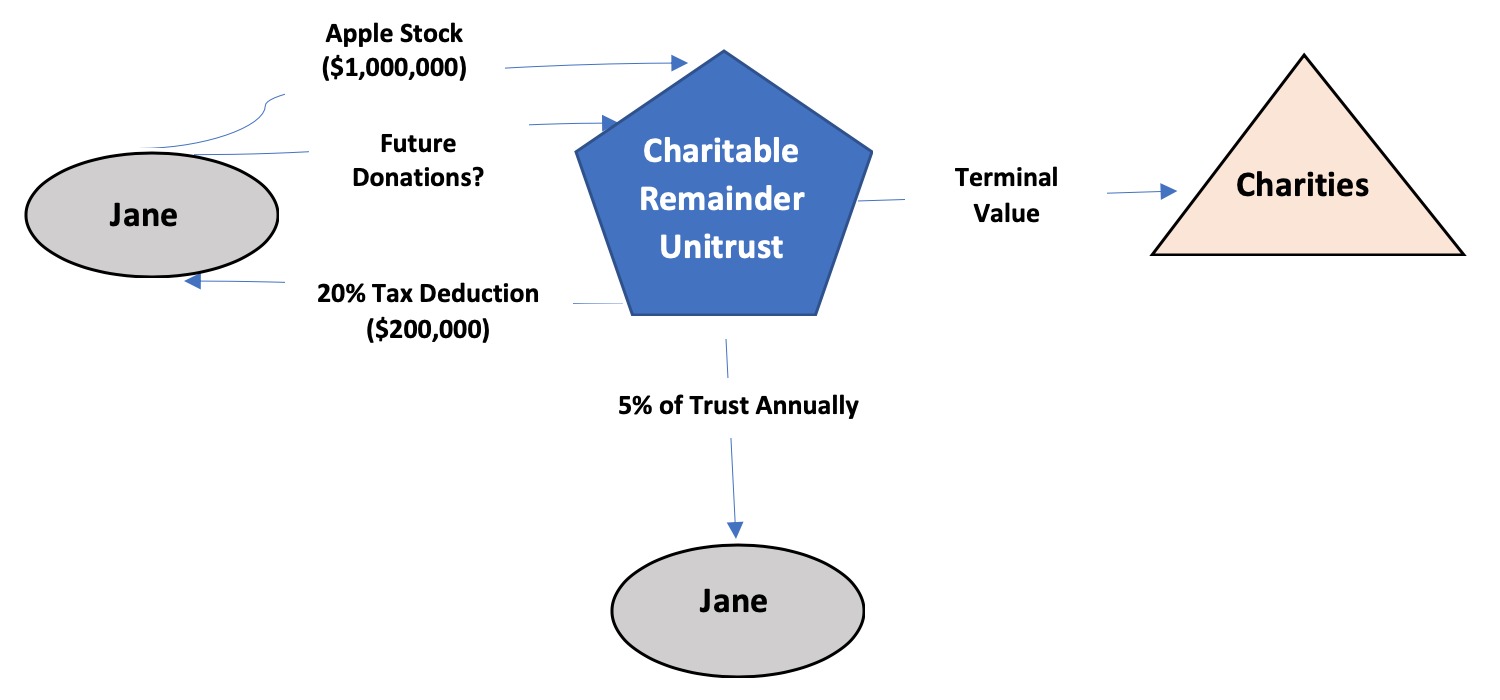

Jane is 60 years old and charitably inclined. We have helped her determine that she has enough assets to live on such that she can comfortably give away a portion to an irrevocable trust. Jane has several highly appreciated assets that she would potentially donate to charities over time, but initially, she wants to only donate one of the assets. She would be a candidate to discuss creating a Charitable Remainder Unitrust (a unitrust pays income on a percentage of assets and allows for multiple contributions).

Jane owns Apple stock with a market value of $1,000,000 and cost basis of $200,000. If she were to sell the stock, she would incur capital gains tax around $190,400 (Market Value minus Cost Basis)*(Capital Gain Tax Rate 23.8%). By transferring the stock to the Charitable Remainder Trust, the trust can then sell the stock to create a diversified portfolio and avoid a capital gains tax.

She elects to donate the stock to a charitable remainder trust and become the income beneficiary of the trust. She may receive the following (1) upfront tax deduction of around $200,000 (this is a calculation that is done by a tax advisor) and (2) income stream of 5%.

At Jane’s passing, the amount left in the trust will go to her charities of choice.

Case Study 2

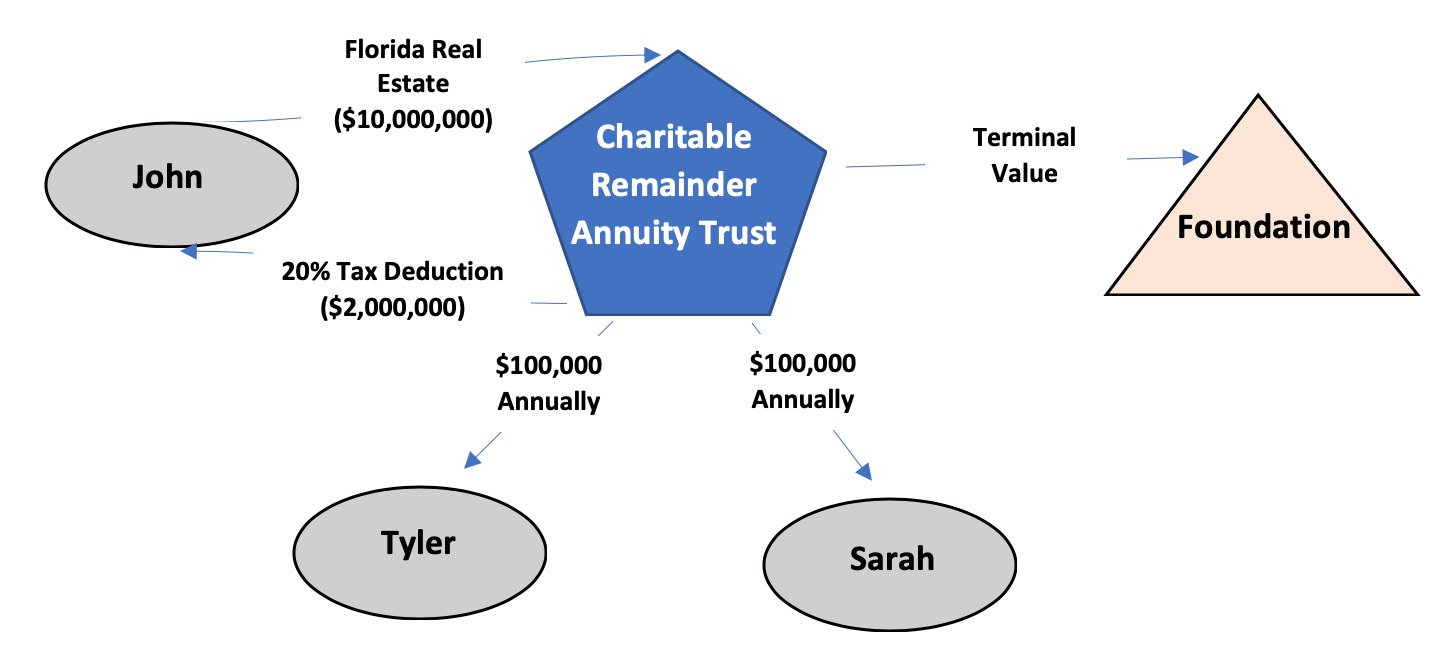

John is 50 years old, and his financial advisors have determined he will have a taxable estate at his passing. However, if John gifts a one-time amount of $10,000,000 to an irrevocable trust today, his heirs will face no estate taxes, potentially saving millions in the future.

John has substantial real estate in Florida worth $10,000,000 with a $3,000,000 cost basis that he no longer wants, however, he does not want to sell it due to the substantial capital gains tax. Additionally, John sold a business this year and faces a substantial tax bill at year-end. John is charitably inclined and monetarily supports his parents. His financial advisors recommend a charitable remainder annuity trust (an annuity trust pays income based on a specific dollar amount, but does not allow for multiple contributions).

John has started multiple charitable foundations, and he also supplements both his parents (Tyler and Sarah) $100,000 each. His advisors recommend donating the property to a Charitable Remainder Annuity Trust so his parents can receive a guaranteed income stream and at their passing the remainder will go to John’s foundations. Additionally, John will receive a large upfront tax deduction and avoid paying substantial capital gains tax.

Case Study 3

The SECURE Act, signed into law in 2019, has dramatically changed the way stretch IRA distributions are handled for non-spouse beneficiaries. This change creates another scenario where charitable remainder trusts can be used to realize a tax benefit.

Jerry is 70 years old and has a history of making charitable contributions. He has $1,000,000 in an IRA and would like to name his 45-year-old son the beneficiary. With the law changes around stretch IRAs put into place by the SECURE Act, once Jerry’s son inherits the retirement account, he’ll have to withdraw the total balance within 10 years.

To mitigate this, Jerry could establish a charitable remainder trust during his lifetime naming his son the income beneficiary and the remainder to the charity. Jerry can then name this trust the beneficiary of his IRA. When Jerry passes, his son will be able to receive income from the trust for as long as he lives. Please note this strategy is only deemed permissible if the income beneficiary is at least 27 years old.

Another strategy Jerry could utilize to tax-efficiently give to charity would be to make Qualified Charitable Deductions (QCDs). Jerry could do both, i.e. make QCDs out of his IRA during his lifetime and then when he dies, the IRA would fund the CRT, thereby providing his son an income stream and ultimately whatever is left would go to charity.

CRT Requirements and Other Guidelines

- The IRS requires the income payout must be at least 5%, but less than 50% of the initial fair market value gifted to the trust. All else equal, a lower payout rate to the income beneficiary will yield a higher current income tax deduction for the donor. The income tax deduction may be carried forward for five years.

- The donor can remain as trustee and beneficiary, but the trust must be irrevocable (meaning the donor cannot change their decision).

- The income payout from the trust can be based on the beneficiaries’ life spans or a set time period (maximum is 20 years).

- The income payout cannot be adjusted for inflation. However, the income payout can be delayed so the trust can grow. A Charitable Remainder Unitrust (CRUT) allows for multiple contributions and provides an income stream based on a fixed percentage of assets, whereas a Charitable Remainder Annuity Trust (CRAT) allows for a single contribution and provides an income stream based on a dollar amount.

- Most assets are accepted to be gifted into this type of trust except stock in an S-Corporation and usually mortgaged real estate. If an asset donated is not easily marketable, the trust can be designed to pay the lesser of a fixed percentage of assets or actual income earned with a provision that allows for catch up distributions.

Do you think a Charitable Remainder Trust would be an effective part of your long-term financial strategy? Talk to one of our financial advisors to see if a CRT would make sense for you.