It’s easy for the long-term investor to look at the S&P 500’s performance in recent years and consider abandoning other asset classes such as US small cap, international and emerging market stocks. After all, the S&P 500 contains brand-name companies like Google, Amazon, and Apple.

But momentum like this typically does not go on forever. The S&P 500’s record closes have been a source of excitement and angst for many investors who are wondering how long U.S. large cap companies can outperform their mid and small cap counterparts.

Before you decide to put all your eggs in the S&P basket, let’s take a look back in time for a historical perspective on the S&P.

The Bull Market, 1982-2000

In late 1982, while Americans were experiencing a grueling economic recession, the markets began a climb that would span close to two decades. Brand new technologies, global economic growth, and a burgeoning middle class all contributed to the rise of the great bull market.

The S&P 500 experienced substantial growth during this period. It entered 1982 at 117.30. On January 1st, 2000, it was 1425.59.

In the year 2000, the S&P was at a record high. Investors may have looked at these results and flirted with the idea of putting all their holdings in the index. But if you picked 2000 as the year to start chasing returns in the S&P, you were in for a rude awakening.

The 2000s: The Lost Decade

Propelled by the late-90’s tech bubble, the S&P hit a record high of over 1500 in August of 2000. Then, the bubble burst. The index shed 40% of its value over the next two years. After bottoming out in late 2002, the index embarked on a steady climb over the next half-decade, again crossing the 1500 mark in the tail end of 2007.

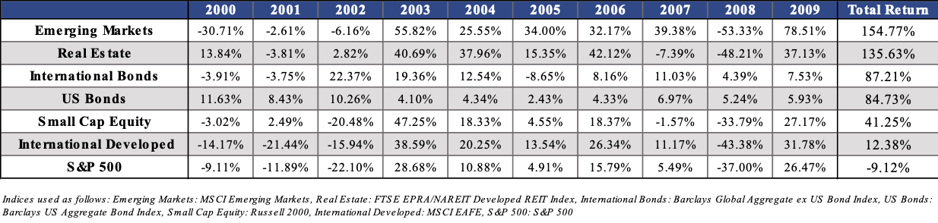

Of course, after that, the financial crisis of 2008 happened. By the end of the 2000s, the S&P 500 finished the decade with a negative return:

*Note: See Disclosure Below

It’s true that no matter what your portfolio looked like in the 2000s, you were probably disappointed in the returns. But a diversified portfolio would have outperformed an all-S&P investment strategy during the decade.

Is the S&P 500 a Diversified Portfolio?

The very nature of index funds leads many to believe they are, in themselves, diversified portfolios. The S&P is composed of 500 large companies across many diverse industries. But take a look at the index’s individual components, and you’ll notice a troubling trend. The five largest tech companies (Apple, Microsoft, Amazon, Facebook and Google) represent almost 23% of the index as of 9/3/21.

Why Diversification Works

There will always be a hot stock, index fund, or market at any given time. In the world of investing, we typically tell our friends about the success stories. We rarely, if ever, speak about the underperformers.

Diversification done right means you should participate, even a little bit, in investing in the success stories. And diversification helps minimize the impact of the underperformers, since you are not concentrated in one segment of the market. This should lead to smoother and less volatile returns over time.

History has shown us that the timing for when a particular stock or index of stocks is going to go up or down is unpredictable. A diversified portfolio is the best tool for those of us who can’t see into the future. And that happens to be all of us.

Investing for your future involves so much more than just chasing gains. It’s about managing risk and using past insights to illuminate the best path forward. If you’re wondering how to best position your investment portfolio for the future, we’d love to discuss your investment strategy with you.

*Disclosure: Performance returns shown in this report are calculated using time-weighted rate of return methodology. The indexes presented herein are provided for illustrative purposes only. Indexes are unmanaged, reflect reinvestment of income and dividends and do not reflect the impact of advisory fees. Investors cannot invest directly in an index. The volatility of these indexes may be materially different from the volatility of a client portfolio due to varying degrees of diversification and/or other factors. Past performance is not indicative of future results.